An insightful conversation unfolded recently on PreMarket Prep, featuring the Chief Investment Officer of NewEdge Wealth, Cameron Dawson. Let’s delve into the fascinating crux of the matter.

Oil, Inflation & Consumer Spending

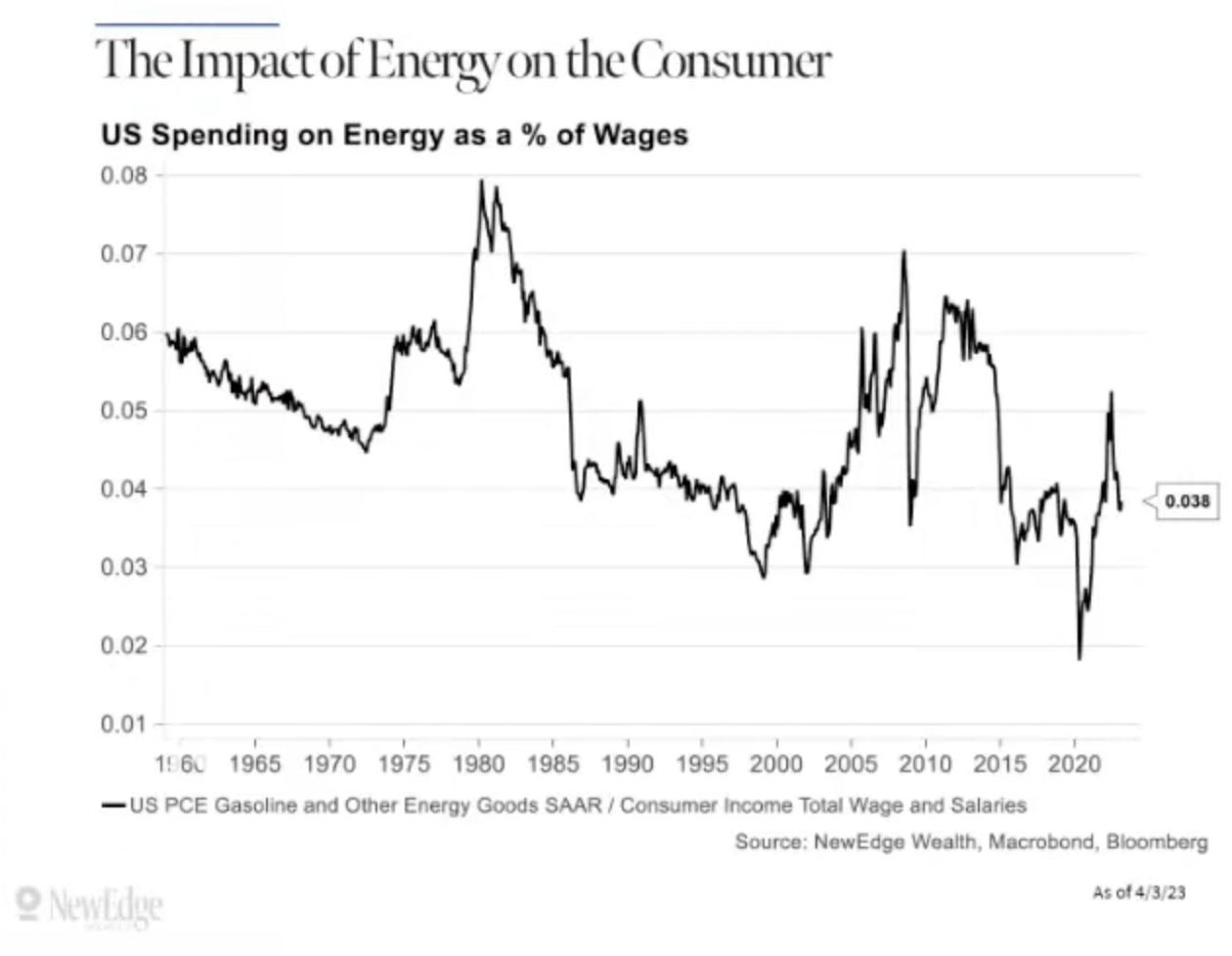

Amidst the turmoil of escalating oil prices, the impact on the global consumer remains uncertain. While oil intensity within the economy has seen a steady decline, a critical threshold of oil spending as a percentage of wages has been reached. Dawson cites the University of Michigan consumer confidence survey is low, signaling that consumers are feeling the pinch.

Simultaneously, an intriguing paradox emerges: despite dismal consumer sentiment, spending remains robust. This dichotomy between soft data and hard data has raised eyebrows among financial experts, as PMIs languish and industrial production thrives. The question then becomes: will soft data eventually converge with hard data?

Simultaneously, an intriguing paradox emerges: despite dismal consumer sentiment, spending remains robust. This dichotomy between soft data and hard data has raised eyebrows among financial experts, as PMIs languish and industrial production thrives. The question then becomes: will soft data eventually converge with hard data?

Dawson posits that loan growth acceleration could be a harbinger of economic downturns. Curiously, loan growth often surges when the Fed raises rates, a trend attributable to banks’ predilection for lending at higher rates and the robust economy’s demand for loans. However, the tipping point occurs when external factors compel banks to curb lending.

Examining historical precedents, Dawson notes that significant loan growth declines occurred in conjunction with Bear Stearns, Enron, and other accounting scandals. Thus, tracking commercial and industrial loan growth could be instrumental in gauging the risk of recession and subsequent earnings downturns.

Market liquidity has seen a notable boost in the first quarter of 2023. Pundits ponder whether this influx of liquidity parallels the 2016-2019 period or reflects the somber reality of the early 2000s and 2008, when Fed liquidity injections failed to offset earnings declines.

Debt & The Fed

Turning our gaze to the precarious state of ballooning debt in the face of rising interest rates, Dawson highlights the relatively stable delinquency rates for commercial and industrial loans. However, credit card usage and interest rates have skyrocketed, albeit remaining below pre-Great Financial Crisis levels as a proportion of disposable income.

Corporate balance sheets reveal a shift toward long-term debt issuance, reducing sensitivity to interest rate hikes. This phenomenon, coupled with the U.S. dollar’s reserve currency status, has somewhat mitigated fiscal constraints. Nevertheless, the ever-increasing national debt raises questions about the government’s capacity to maintain spending in a high-interest-rate environment.

Finally, Dawson emphasizes the significance of employment rates in predicting consumer spending trends. As large-scale layoffs announced in the first quarter begin to materialize in the second quarter, initial jobless claims data will be pivotal in assessing the impact on the economy.

Key Points to Pay Attention To

In summary, the insightful exchange with Cameron Dawson sheds light on various factors shaping the financial landscape, from oil prices and loan growth to consumer sentiment and employment rates. As we forge ahead into the unknown, only time will reveal the true trajectory of our global economy.